Recent bank failures grabbed headlines and sparked economic concern.

For some businesses, the collapses of U.S.-based banks coupled with concerns in the European banking sector required immediate action. But a great majority stuck with the status quo.

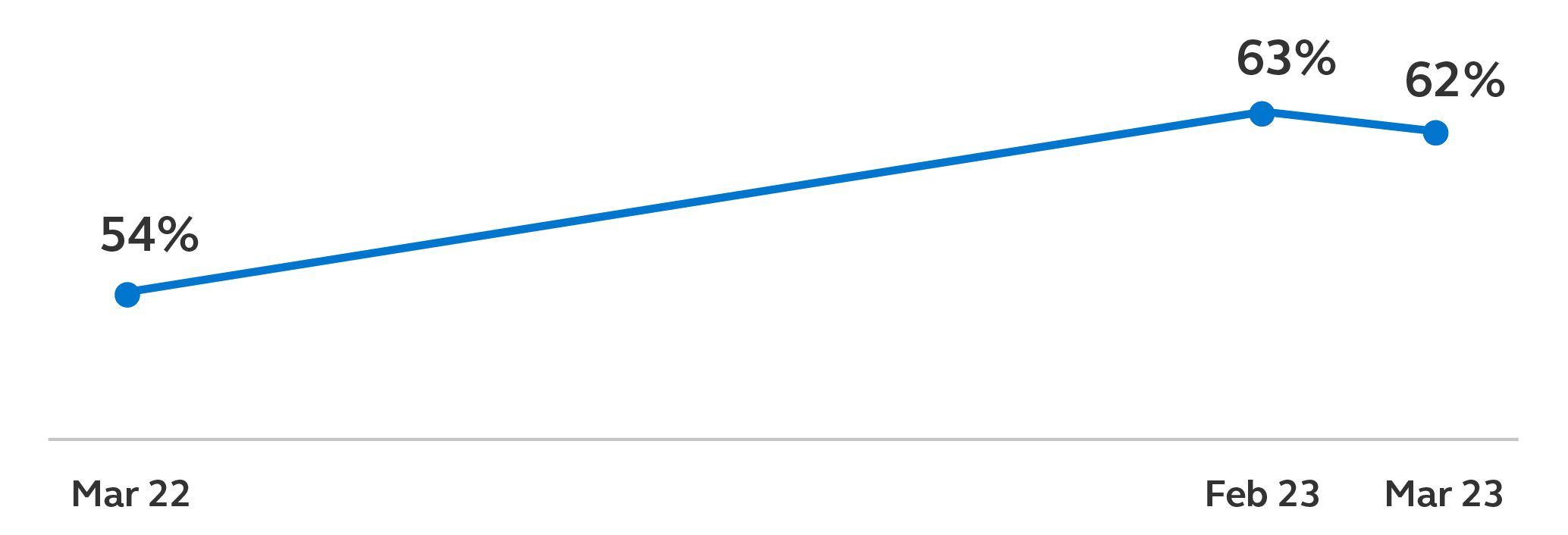

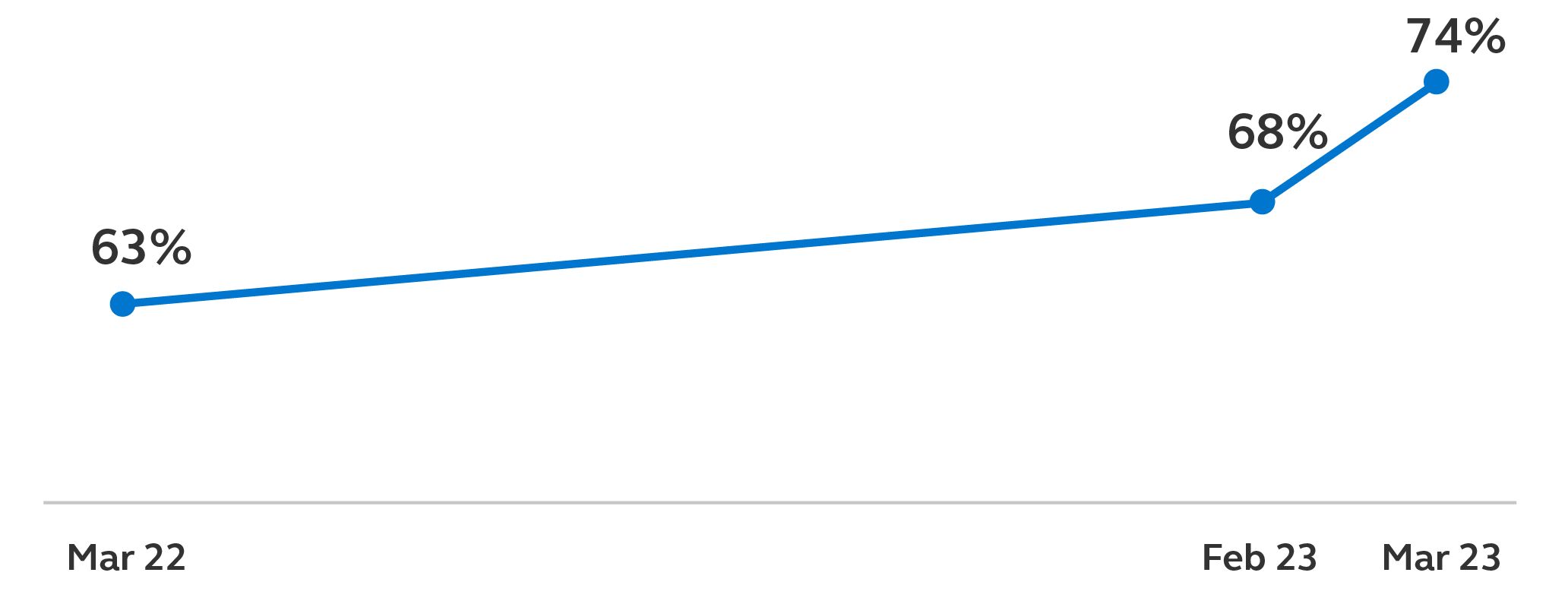

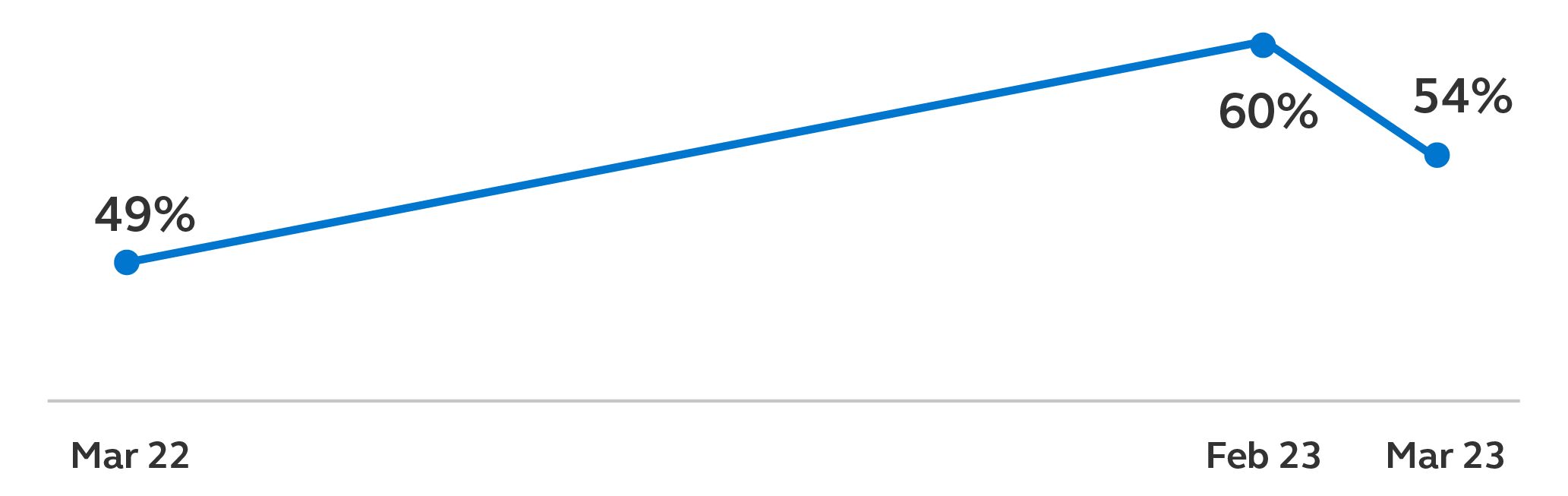

The ║ŻĮŪ╔ńŪ°Financial Well-Being IndexSM shows relatively positive business sentimentŌĆöwith growth rates still notably strong compared to this time last year.

Year-over-year growth1

Year-over-year growth1

Year-over-year growth1

Businesses arenŌĆÖt panicking over the news, but they are on alert.

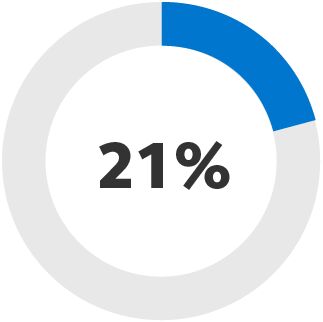

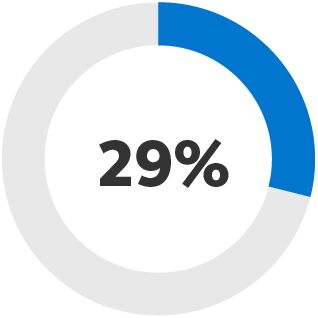

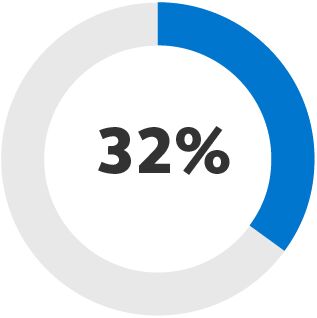

Businesses concerned about the safety of their bank deposits1

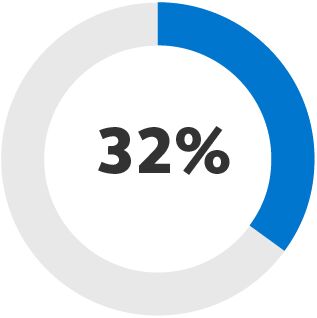

Businesses concerned about having access to capital1

What can businesses do to help mitigate risk?

No matter how unfathomable it seems that your businessŌĆÖs bank may someday collapse, itŌĆÖs worth learning from the past, exploring what other businesses are doing, and taking steps to help mitigate risk.

Here are three good places to start:

1. Distribute your account balances.

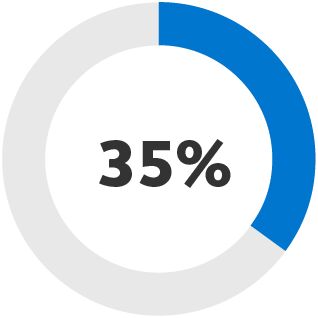

of businesses have already done this1

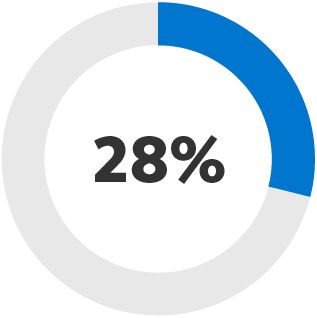

of businesses would plan to1

A foundation of bank account protection is FDIC insurance. Provided by most credible financial institutions, this deposit insurance protects checking and savings accounts, money market deposit accounts, certificates of deposit, and some other assets up to $250,000.

.

All deposits for each account ownership category at a single FDIC-insured bank are added together and protected up to this limitŌĆöthough the personal accounts of business owners or partners are generally separate.

Realizing your businessŌĆÖs total bank balance is approaching or exceeding that magic number? ItŌĆÖs time to explore your distribution options. Choose another bank (more on that in a moment), spread out that money, andŌĆöas your biz continues to growŌĆöcontinue to track that no one institution has more than the FDIC insurance limit.

2. Examine the financial stability of your bank(s).

of businesses have already done this1

of businesses would plan to1

While FDIC insurance is a massive safety net, cashing in on it can be a headache. The first choice is, of course, to work with a financially stable bank. So, howŌĆÖs yours doing?

Bank supervision and inspections fall under the Federal Reserve. Research if itŌĆÖs issued any reports about or serious corrective actions against your financial institution.

You can also look up your bankŌĆÖs Texas ratioŌĆöa figure meant to indicate financial trouble or credit problems. The higher the ratio (beyond 1:1 or 100), the worse financial shape an institution may be in. But remember it doesnŌĆÖt explicitly mean theyŌĆÖre on the brink. Like most indicators, this oneŌĆÖs meant to be used with other analyses.

Another good resource may be buried deep in your deleted email folder: quarterly and annual reports. These reveal deposit growth, available capital, and many indicators of financial stability.

3. Collect outstanding debt.

of businesses have already done this1

of businesses would plan to1

YouŌĆÖre taking steps to protect your businessŌĆÖs money. Now, make sure that money is in your accountsŌĆöprotected and accessible amid a volatile market.

That means collecting outstanding debt.

While your approach will depend on circumstances, starting casually is usually favorable to starting litigiously. You may consider reissuing invoices, developing a payment plan option with automatic or recurring payments, or withholding services until debts are paid.

If met with resistance, sending a demand letter or filing with a credit bureau or collection agency may eventually make sense.

You work hard to build a fruitful, financially secure business. With a few precautions and efforts, banking politics shouldnŌĆÖt get in the way.