Using retirement savings to pay off debt can have an impact on your financial foundation now and in the future.

The average full-time employed American works about 8.5 hours a day,

On the flip side, though, if you’ve started saving for retirement, you may have made good progress. For example, the average working household ages 45–54 with a 401(k)/individual retirement account (IRA) has accumulated a savings of about $115,000.

If you’re trying to get out of debt, those retirement savings are tempting. “We sometimes think, 'I have these retirement savings at my disposal,’” says Stanley Poorman, financial professional with Principal®. “But that’s there for retirement. There are other tools to use.”

In fact, raiding your retirement savings to pay off debt may equal more short- and long-term costs than you realize. Here are some tradeoffs to consider.

You’ll pay penalties and taxes for using retirement savings to pay off debt.

Every retirement account—a traditional IRA, Roth IRA, and 401(k)—has age distribution limits. That means some combination of penalties and taxes may hit you for early withdrawals.

| Account type | Early withdrawal costs |

|---|---|

| IRA | You’ll get dinged with a 10% penalty on the full amount you withdraw, plus taxes at your current income tax bracket. (Some exceptions to the penalty charge, like using funds for a first-time homeowner down payment, apply.) |

| Roth IRA | It’s important to distinguish between contributions and earnings for a Roth IRA. You can withdraw the former at any time and any age, tax- and penalty-free (remember, you’ve already paid taxes on Roth IRA contributions). If you withdraw earnings at any time, you must pay taxes on them. If you make a withdrawal before the account is five years old, you’ll pay a 10% penalty and taxes. |

| 401(k) | You’ll pay a 10% penalty on the withdrawal plus taxes at your current rate. |

Let’s say that you have $20,000 in credit card debt. What are the true costs (and how much will you really see) if you withdraw from a 401(k) to pay it off?

| Withdrawal | Subtract your early withdrawal penalty | Subtract your estimated income tax | The withdrawal amount |

|---|---|---|---|

| $20,000 | $2,000 | $4,000 | $14,000—leaving you with $6,000 in your original debt |

You may lose out on potential earnings if you use retirement savings to pay off debt.

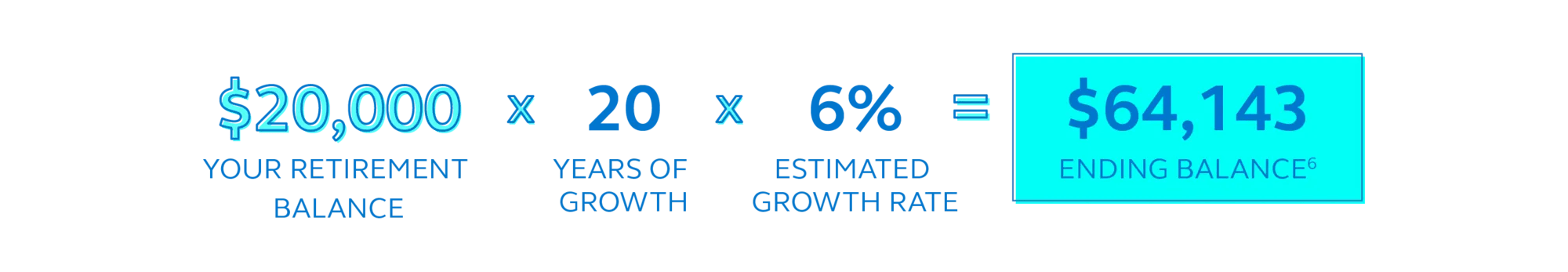

If you withdraw that $20,000 to pay off debt, you’re also eliminating the opportunity to grow those funds over the long-term—otherwise known as compounding interest.

“Weigh all the impacts,” Poorman says. “Some impacts you can recover from, and some you may not. Can you really ramp up your retirement savings rate to recover? You may be giving up substantial returns, year over year.”

You’ll have to adjust your budget if you take a 401(k) loan with retirement savings.

If you don’t have another option for your debt but are wary of withdrawing from your retirement savings, you may consider a 401(k) loan.

- Limitations: Up to 50% of vested account balance or $50,000 (whichever is less), in a 12-month period, unless the balance is less than $10,000 (then the borrowing limit is $10,000). Some plans don’t allow 401(k) loans. (The .)

- Payback: Within five years, with payments made quarterly and with interest, which goes into the 401(k); if you leave your job, you must pay back the loan first.

- Taxes and penalties: None if you meet the terms of the loan. If you don’t repay the loan, you’ll be charged taxes and penalties.

- Costs: You’ll miss out on possible account growth during your loan repayment period.

Caution is key, Poorman says: A 401(k) loan is just that—a loan—so you’ll be required to make monthly payments. Each month you have income that you can divvy up however you want—retirement, vacations, dinners out, and more. Your money is a tool for you to balance those tradeoffs and achieve your goals. “It’s all about tradeoffs,” Poorman says. “(A 401(k) loan) will reduce your monthly income, so make sure it doesn’t put you in a worse situation for the immediate future,” he says.

Fundamentals—a budget that aligns with your income and expenses—can help. And you may have debt repayment choices that help ease some of the pressure, Poorman says, including consolidation or negotiating with a creditor to figure out a reasonable repayment schedule.

“You want to review every other option first,” Poorman says. “Would you have to work longer to make up those funds you withdrew? Would you end up in a similar situation a few years from now?”

What’s next?

Working on a budget and trying to figure out what debts to pay and how much to save? Log in to your şŁ˝ÇÉçÇřaccount to assess your retirement savings rate so you can see how much progress you’re making toward your goals.