What’s a RILA

Like other annuities, RILAs are long-term, tax-deferred investments. They offer investment options—called segments—that are linked to a specific market index for a set period of time. This gives you a level of control over how your assets are invested and for how long.

- Growth is based on the performance of the underlying indices you choose, up to a set participation rate or cap.

- Index credits are what provide growth potential for your investment. Credits are based on the performance of the underlying index from the start date to the end date of your investment period.

- RILAs also offer you some protection from investment loss. Loss is limited by either a buffer or floor.

Take control of your retirement planning

Invest for growth potential

Designed to keep your money growing in positive markets.

Help protect against loss

Limit some investment losses in down and volatile markets.

Make it personal

Choose between various index allocations, growth strategies, and investment protections.

How Principal® Strategic Outcomes works

It’s all about choice. These choices help you personalize your investments to your specific goals.

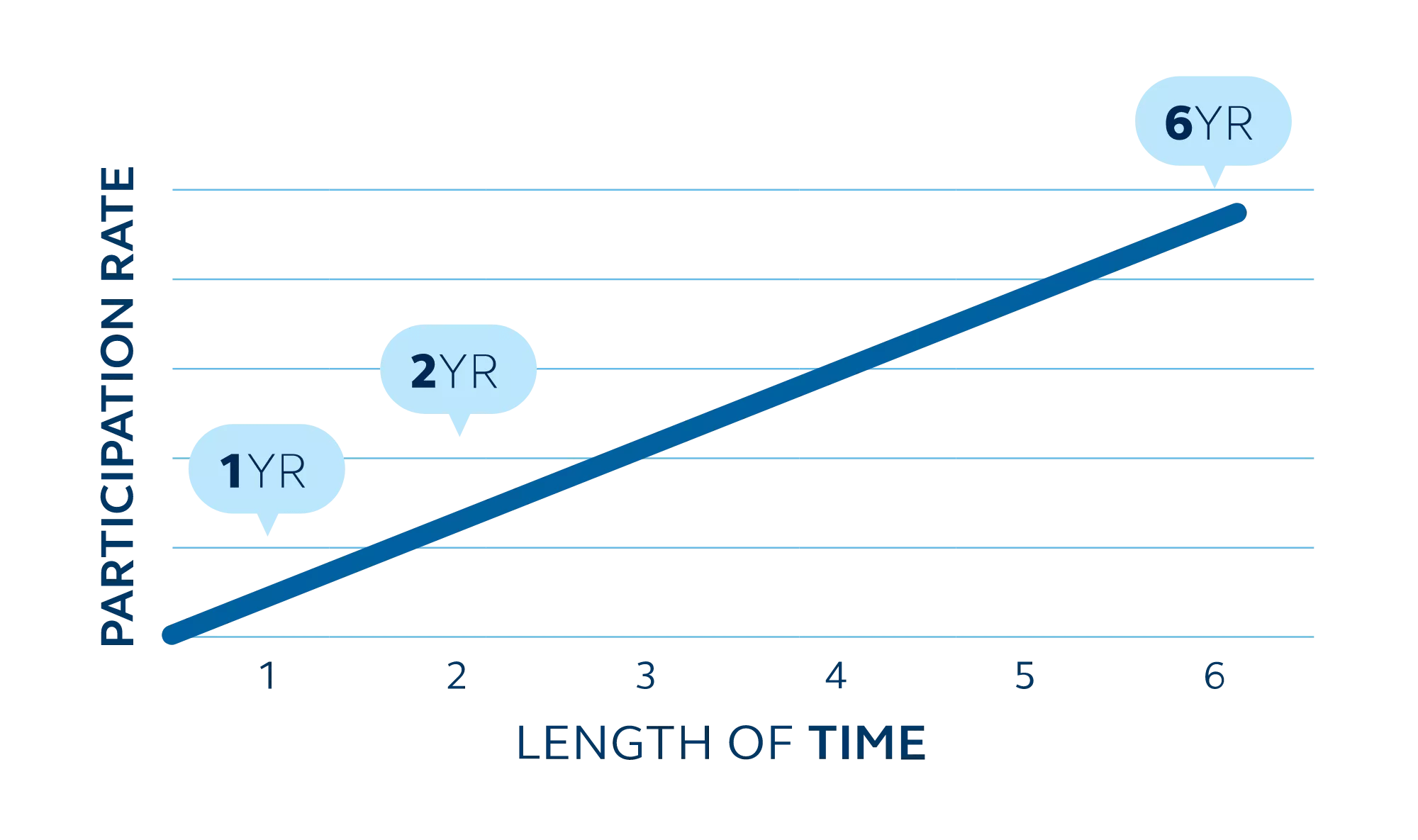

Longer investment options may offer a higher participation rate, providing the opportunity for higher account gains. Shorter options give you more investment flexibility by allowing you to move your assets around more frequently.

şŁ˝ÇÉçÇřStrategic Outcomes offers investment options of one, two, and six years. You select the segment term, which is how long you want to invest money in that investment option.

1-year term

Enjoy the highest level of flexibility. You can reset your protection level each year and realize any earnings on an annual basis.

2-year term

You’ll still have investment flexibility with this option and benefit from higher participation rates than the 1-year segments.

6-year term

This option has the highest participation rates which means more growth potential in exchange for less flexibility.

What index or indices do you want to participate in?

You can choose from three well-known indices or an ESG index. The performance of the index will determine your investment growth.

Each investment option tracks and provides credits – either positive or negative. Crediting is based on the change to the index between your segment start and end dates. Credits are applied when your chosen investment option ends.

şŁ˝ÇÉçÇřStrategic Outcomes offers two protection levels – a buffer and a floor. Both protect you from some investment loss. We also offer two full protection options.

Buffer option

A buffer protects you from losses up to the stated buffer. You absorb any losses beyond the buffer.

Floor option

You absorb losses up to the stated floor but are protected from losses beyond that. We offer a 0% floor which protects you from any loss.

You have two different growth strategies available to you—a participation rate or a cap.

A participation rate is used to determine the amount of credit given on an investment. Any positive change in the underlying index is multiplied by the participation rate. The rate may be more or less than 100%.

A cap is the maximum return available to you when the index performs positively.

Participation and cap rates are included in exchange for the downside protection provided and may limit your investment performance.

4 different hypothetical scenarios to help demonstrate how this works

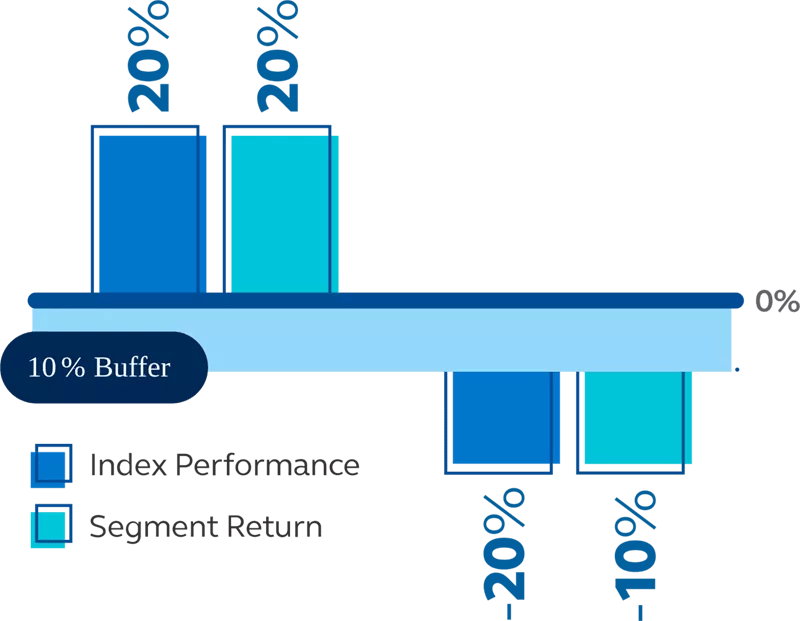

10% buffer with a participation rate

UP MARKET SCENARIO

The index performance is +20% with 100% participation rate. Your return would be +20%.

Your ending value:

$120,000

DOWN MARKET SCENARIO

The index performance is -20% with a 10% buffer. Your return would be -10%.

Your ending value:

$90,000

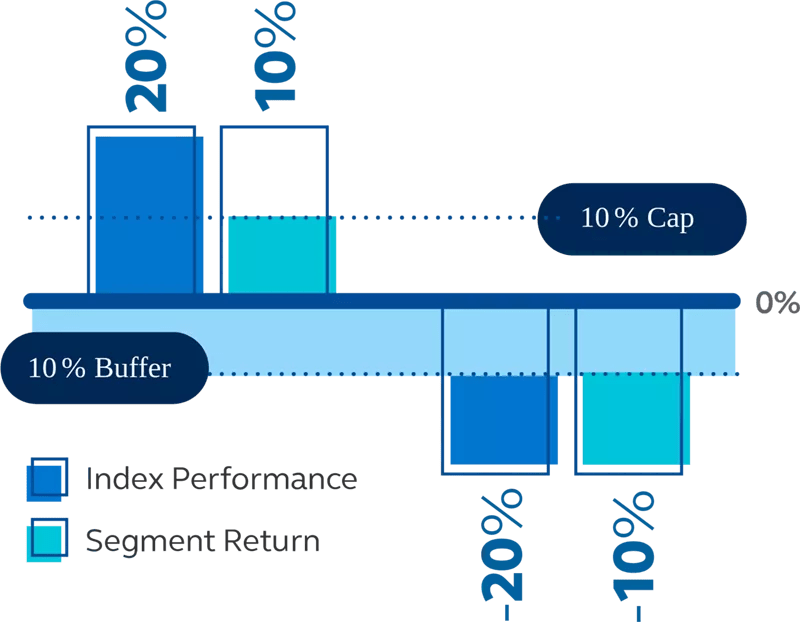

10% buffer with a cap

UP MARKET SCENARIO

The index performance is +20% with a 10% cap. Your return would be +10%.

Your ending value:

$110,000

DOWN MARKET SCENARIO

The index performance is -20%. With a 10% buffer, your return would be -10%.

Your ending value:

$90,000

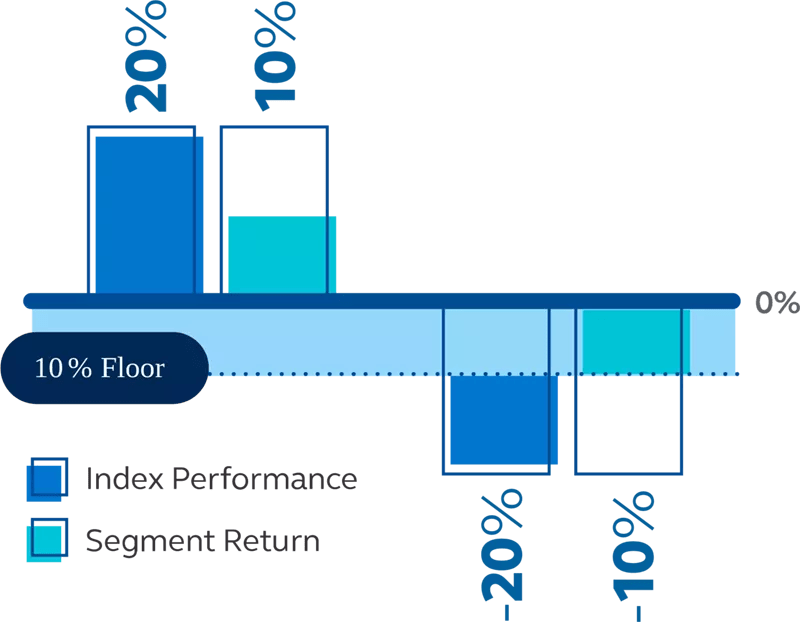

10% floor with a participation rate

UP MARKET SCENARIO

The index performance is 20% with a 50% participation rate. Your return would be 10%.

Your ending value:

$110,000

DOWN MARKET SCENARIO

The index performance is -20%. With a 10% floor, your return would be -10%.

Your ending value:

$90,000

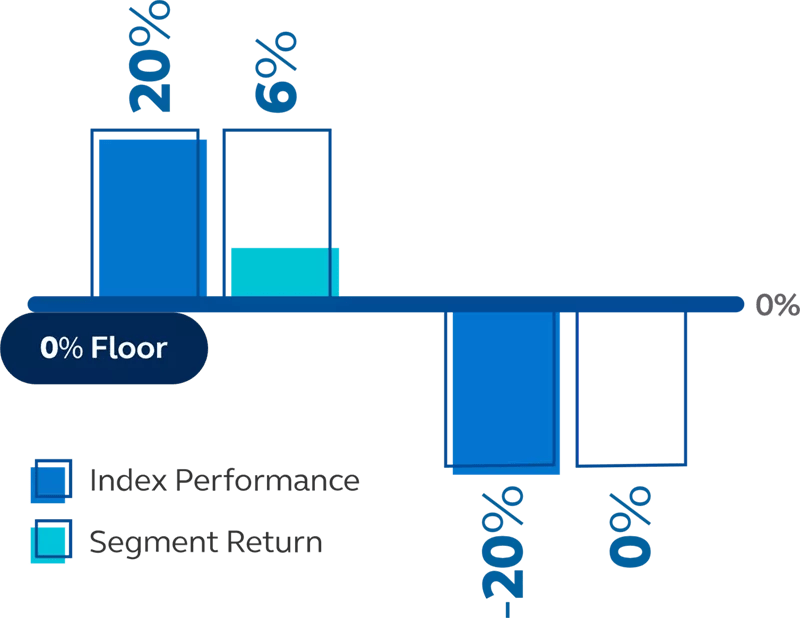

0% floor with a participation rate

UP MARKET SCENARIO

The index performance is +20% with a 30% participation rate. Your return would be +6%.

Your ending value:

$106,000

DOWN MARKET SCENARIO

The index performance is -20% with a 0% floor. Your return would be 0%.

Your ending value:

$100,000

All examples are hypothetical and are not meant to show actual results or predict future results. It’s intended to be educational in nature and is not intended to be taken as a recommendation. Your circumstances and experience will be different than that shown.

Is Principal® Strategic Outcomes right for you?

This could be a good investment for you if:

- You're interested in keeping money invested for potential growth.

- You want some loss protection if markets go down.

- You're looking for tax-deferred growth.

- You’re comfortable keeping your money in a long-term investment.

- You want the flexibility to change your investment strategy if your financial goals change.

Talk with your financial professional to learn more and determine if şŁ˝ÇÉçÇřOutcome Protector is right for you.